In this case, gambling disorders, expected to expand dramatically in the coming years, due to the explosive growth of online betting– which began when the Supreme Court overturned an existing Federal ban on sports wagering.

Much of that growth is expected to be among young adults, 18 to 25 years of age, many of them in college, the military, etc. Perhaps away from home for the first time, during a key period in the emergence of chronic behavioral disorders.

Governments are having to scramble to keep up. The Guardian offers a look at one attempt, at the Federal level, to address the problem through legislation:

‘A serious disease’: Congress weighs federal gambling crackdown amid growing concerns

From the article: “Lawmakers must dedicate ‘significantly more attention’ to gambling on college campuses, said Charlie Baker, the former Massachusetts governor and current president of the National Collegiate Athletics Association, in order to protect both students and organized sports “…from the dangers of pervasive sports betting.”

Like most issues that come before Congress, funding is of key importance. At present, we’re advised, far less than one cent out of every dollar from commercial gambling goes to services for problem gamblers.

That’s in spite of the estimated 2.5 million U.S. adults who meet criteria for a severe gambling problem.

“Gee, that’s not much money for a problem of that scope,” remarked one counselor on first hearing. No, it sure isn’t.

Legislation under consideration would help to remedy this. For instance, the GRIT (Gambling Addiction Recovery, Investment and Treatment) Act wants to take advantage of fast-rising revenues from the existing Federal sports excise tax.

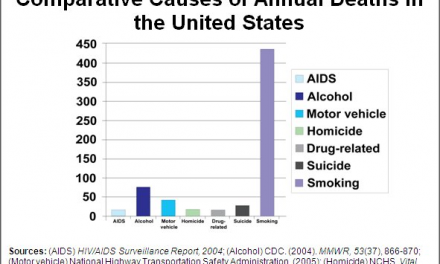

Excise taxes, if you’re not familiar, are imposed on sales of goods and services, not only gambling but also tobacco products, alcoholic beverages, airline tickets, and a host of others. Last year, the excise tax on gambling alone raised an estimated $271 million dollars.

The new law would dedicate half of that amount– around $135 million– to Federal grants for prevention, treatment, and research on gambling disorders.

As you might imagine, the commercial gambling industry is dead-set against it. In fact, they’d like to eliminate the gambling tax altogether, on the grounds that it disadvantages them in their ongoing competition with illegal gambling operations.

As arguments go, this struck me as “let us keep all that tax revenue so we can continue to spend less than 1% on helping people deal with the problems we helped to create.”

Self-serving is how I would describe that. Let’s hope the government comes up with something better.